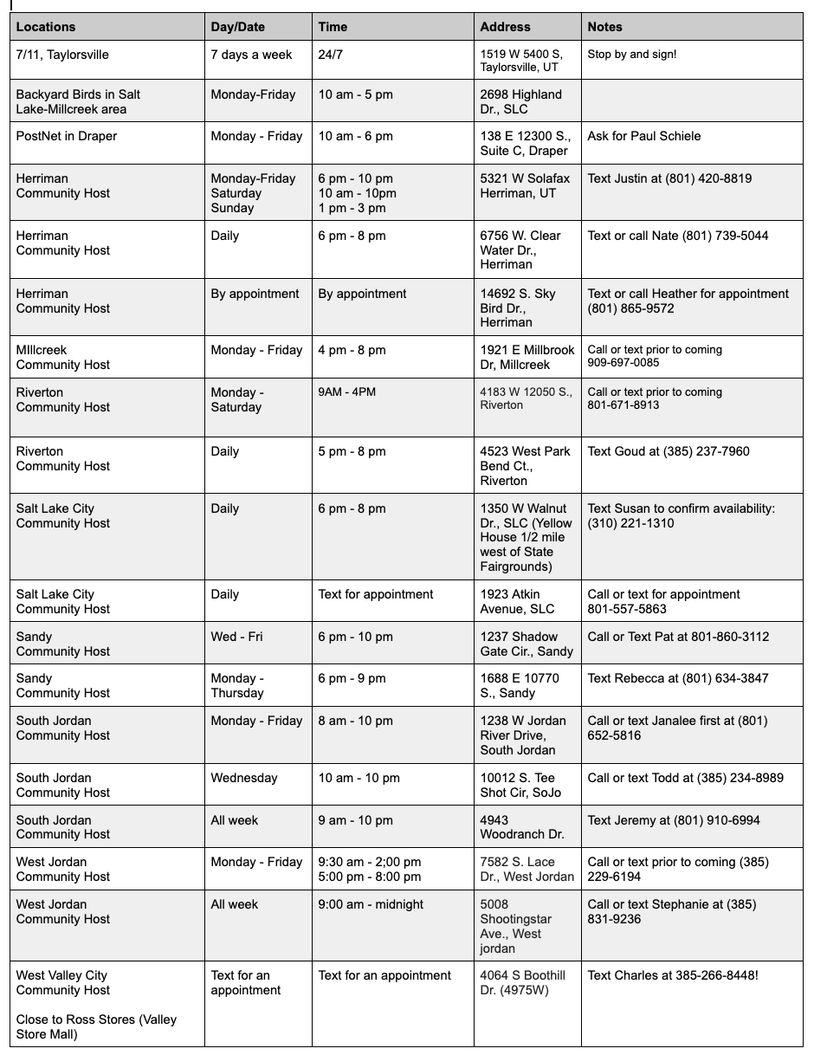

Referendum Signing Locations

Find out More or Join the Referendum to Ax the Tax

What's Happening — Tax & Referendum in Salt Lake County

January 2: Press Release

The referendum to stop Salt Lake County’s proposed 15% property-tax increase has been officially approved, and signature collection is now underway.

If enough valid signatures are collected within 45 days, the tax increase will be paused and placed before voters later this year.

The referendum does not cut services or defund public safety, but temporarily halts the increase while the County evaluates budget alternatives and efficiency improvements.

Tax Referendum given Go-Ahead

On December 31, 2025, the Salt Lake County District Attorney’s Office approved our tax referendum, officially allowing us to begin collecting signatures to put this issue before voters

- Now the clock is running. We have:

- 45 days to qualify

- ~45,000 valid signatures required

- Each petition packet holds up to 100 signatures

If we succeed, the tax increase is halted, and voters — not politicians — will decide whether to increase taxes later this year.

Signature collectors: take the training BEFORE collecting

Signature collectors: get your Certificates now!

TAKE THE TRAINING AND GET YOUR CERTIFICATE using

- the QR Code at the right

or

- Use Blue or Black Ink

- We need signatures from registered voters who live in Salt Lake County

- If an individual wants to register to vote, send them here: Your Personal Information | Utah Voter Registration

- Each registered voter may only sign for themselves

- You must witness each signature

- Try to get each signer to provide their age or birthdate because it will make signature verification faster

- Signature collectors cannot sign your own signature packet

- Your packet needs to be submitted within 30 days of when the first signature in the packet was collected

If you have additional questions, please reach out to Goud Maragani at (385) 237-7960 or goud.p.maragani@proton.me.

Salt Lake County Approved a Property Tax Increase

In early December 2025, the Salt Lake County Council, except Carlos Moreno, voted to approve a property tax increase of around 14% as part of the 2026 county budget. This was slightly less than the nearly 20% increase originally proposed by County Mayor Jenny Wilson.

That tax hike is intended to generate about $36.5 million for county services.

Residents Are Pushing for a Referendum to Overturn the Property Tax Increase

A group of Salt Lake County residents, led by Goud Maragani, has filed paperwork seeking to put the tax increase up for a referendum — meaning they want voters to decide whether it should stand.

They argue the increase makes the county less affordable, especially amidst inflation and rising cost of living.

Stay tuned for updates to help with this exciting opportunity to stop this tax increase!

Video

An important Update on the Tax Referendum for Salt Lake County

In this short video, Goud provides an update on the status of this referendum, and encourages viewers to find out more or volunteer, see the section below

Press Release: Salt Lake County Tax Referendum Cleared for Ballot

FOR IMMEDIATE RELEASE

January 2, 2026

Salt Lake County Tax Referendum Cleared for Ballot; Signature Collection Begins NOW to Stop 15% Property-Tax Increase

SALT LAKE COUNTY, Utah — A citizen-led referendum to stop Salt Lake County’s nearly 15% property-tax increase has been officially cleared to proceed, and signature collection is now underway.

On December 31, 2025, the Salt Lake County District Attorney’s Office completed its statutory review and determined that the referendum application is legally referable to voters under Utah law. The Salt Lake County Clerk’s Office subsequently transmitted final materials, allowing sponsors to begin circulating petition packets.

The referendum would prevent the proposed property-tax increase from taking effect and instead allow voters to decide later this year whether the increase should be approved.

“This referendum gives taxpayers a voice before another major tax hike takes effect,” said Goud Maragani, a spokesperson for Tax Referendum Salt Lake County. “Families, seniors, and residents on fixed incomes are already stretched thin. This process ensures voters — not bureaucrats — make the final decision.”

Signature Collection Now Underway

Petition packets are now being printed and distributed. Each packet contains space for up to 100 signatures. Organizers report that volunteers are already mobilizing across the County.

Under Utah law, referendum sponsors must collect approximately 45,000 valid signatures within 45 days in order to qualify the measure for the ballot.

Residents who wish to:

- sign the petition, or

- help collect signatures

can email NoTaxSLCo@gmail.com to request a packet or arrange delivery.

A Vote on Taxes — Not a Cut to Services

Referendum supporters emphasize that the measure does not eliminate County services or defund public safety. Instead, it pauses the tax increase while Salt Lake County evaluates alternatives such as reducing administrative overhead, eliminating duplicative programs, and improving efficiency.

Supporters argue that the County can avoid a tax increase by cutting less than 2% of overall spending, a level of adjustment that families routinely make when budgets tighten.

FACT SHEET: STOP THE 15% PROPERTY-TAX INCREASE

A Responsible Alternative for Salt Lake County

Most residents of Salt Lake County have already absorbed significant property-tax increases from school districts, special service districts, and other taxing entities.

The County’s proposed 15% property-tax increase is the straw that will break the camel’s back for many families, seniors, and residents on fixed incomes.

The County can avoid a tax increase by cutting less than 2% of its spending. Families in Salt Lake County make these types of adjustments all the time. There is no reason the County cannot do the same.

That is why residents are supporting the referendum.

What the Referendum Does

This referendum simply prevents the 15% property-tax increase from taking effect while the County implements responsible, common-sense budget reforms.

- It does not eliminate services

- It does not defund public safety

- It does require the County to live within its means

The County’s Argument — And Why It Falls Short

Opponents of the referendum rely on predictable “the sky is falling” rhetoric.

They warn of cuts to essential services — without first cutting their own administrative bloat or eliminating duplicated programs.

Salt Lake County residents are not arguing for inaction.

They are advocating for responsible, prioritized budgeting that protects core services while eliminating waste and inefficiency.

Our Responsible, Step-by-Step Approach

1. Eliminate Duplication and Administrative Bloat First

Publicly available data (Utah Stories, OpenPayrolls.org) shows:

- 100+ County employees earn over $189,000 per year

- Median household income is approximately $97,000

- Senior administrative staffing has expanded far beyond prior norms

Recommendations

- Reduce senior administrative positions

- Eliminate five Deputy / Associate Deputy Mayor positions

- Retain one Deputy Mayor and one Chief of Staff

- Focus leadership resources on core County functions

2. Eliminate or Consolidate Duplicative County Offices

Within the office of Regional Development (Current budget: $28.3 million), many functions already overlap with:

- Municipal Services District (MSD)

- Wasatch Front Regional Council (WFRC)

- State and municipal economic-development agencies

With little developable land remaining in unincorporated areas, these functions can be consolidated or phased out without harming residents.

3. Improve Public Safety Efficiency — Without Cutting Core Services

Fewer than 11,000 residents live in unincorporated Salt Lake County. Yet the Sheriff’s Law Enforcement Bureau maintains 70+ sworn patrol officers, far exceeding typical ratios, and despite an impending state law requiring annexation of most unincorporated areas.

Recommendations

- Eliminate or substantially reduce the patrol function of the Sheriff’s Law Enforcement Bureau

- Contract remaining patrol needs through UPD or other agencies

- Redirect savings to jail operations and corrections, which serve all County residents

This does NOT affect:

- Jail and corrections

- Court bailiffs

- County building security

4. Apply a Modest, Fair Reduction If Needed

Only after eliminating duplication and excess administration:

- Apply a transparent, uniform reduction of approximately 5% or less

- Protect essential services

- Avoid raising property taxes

The Bottom Line: This situation did not arise overnight.

It is the result of years of unchecked administrative expansion and budget growth.

The County can balance its budget without raising property taxes — and without harming essential services.

Salt Lake County has real, responsible alternatives to a 14% tax hike. The County can balance its budget without raising property taxes — and without harming essential services. By:

- Cutting duplication

- Reducing administrative bloat

- Improving public-safety efficiency

- Applying modest, fair reductions only if needed

✔ PROTECT TAXPAYERS

✔ PROTECT ESSENTIAL SERVICES

✔ SUPPORT THE REFERENDUM

Stop the 15% property-tax increase!

Cut the Bloat, Protect the Essentials

The $28 Million Planning Redundancy

Salt Lake County spends $28 million per year on a planning office that duplicates services the County already pays for elsewhere.

- The MSD Connection: Only about 11,000 residents live in unincorporated areas, but even there the planning, zoning, and long-range land-use are already provided by the Municipal Services District (MSD) — which also performs these functions for multiple cities and municipalities.

- Paying Twice: Salt Lake County is the only MSD client that maintains a separate, duplicative long-range planning office, meaning County taxpayers are paying twice for the same services.

- WFRC Overlap: Salt Lake County has two voting Board members at the Wasatch Front Regional Council (WFRC) to handle overlapping regional transportation and growth planning, and pays substantial dues for that. The county's planning offices wastefully duplicate that.

- The Math: This wasted spending amounts to over $2,500 per resident in unincorporated areas and covers nearly 80% of the proposed tax increase — without cutting a single essential service.

Bloated Management

Excess management layers waste money and slow down decision processes. Lean management is better.

- Executive Salaries: According to Utah Stories, more than 100 County employees earn over $189,000 per year — roughly twice the median household income.

- Administrative Layers: The County now employs 3 Deputy Mayors, 3 Associate Deputy Mayors, and a Chief of Staff. This extreme executive layering exceeds what previous administrations and similarly sized counties use.

- The Goal: Residents don't call for cuts to front-line workers or essential services. They simply ask the County to reduce executive bloat, rein in top-heavy compensation, and demonstrate fiscal discipline before raising property taxes.

The 5% Efficiency Trim

After eliminating duplication and excess management, only a small budget gap remains.

- Closing the Gap: A modest 5% efficiency trim across departments more than closes the remaining gap — without cutting essential services.

- Preserving Essentials: This approach preserves what residents care about most, including:

- Jails and courts

- Public safety

- Libraries

- Senior services

- Parks and recreation

Salt Lake County can balance its budget without raising property taxes.

This referendum asks them to do exactly that.